Understanding

Your Tax Notice

Utah State Law requires the County to issue the Tax Notice each year for real property. This Tax Notice not only has taxes collected by the County, but also other taxing entities in the area. Such as: State School Board, Special Service Districts, City Government, Local School Board and possibly others.

The amount that the County collects from you each year, is then distributed to each of the entities listed on your Tax Notice.

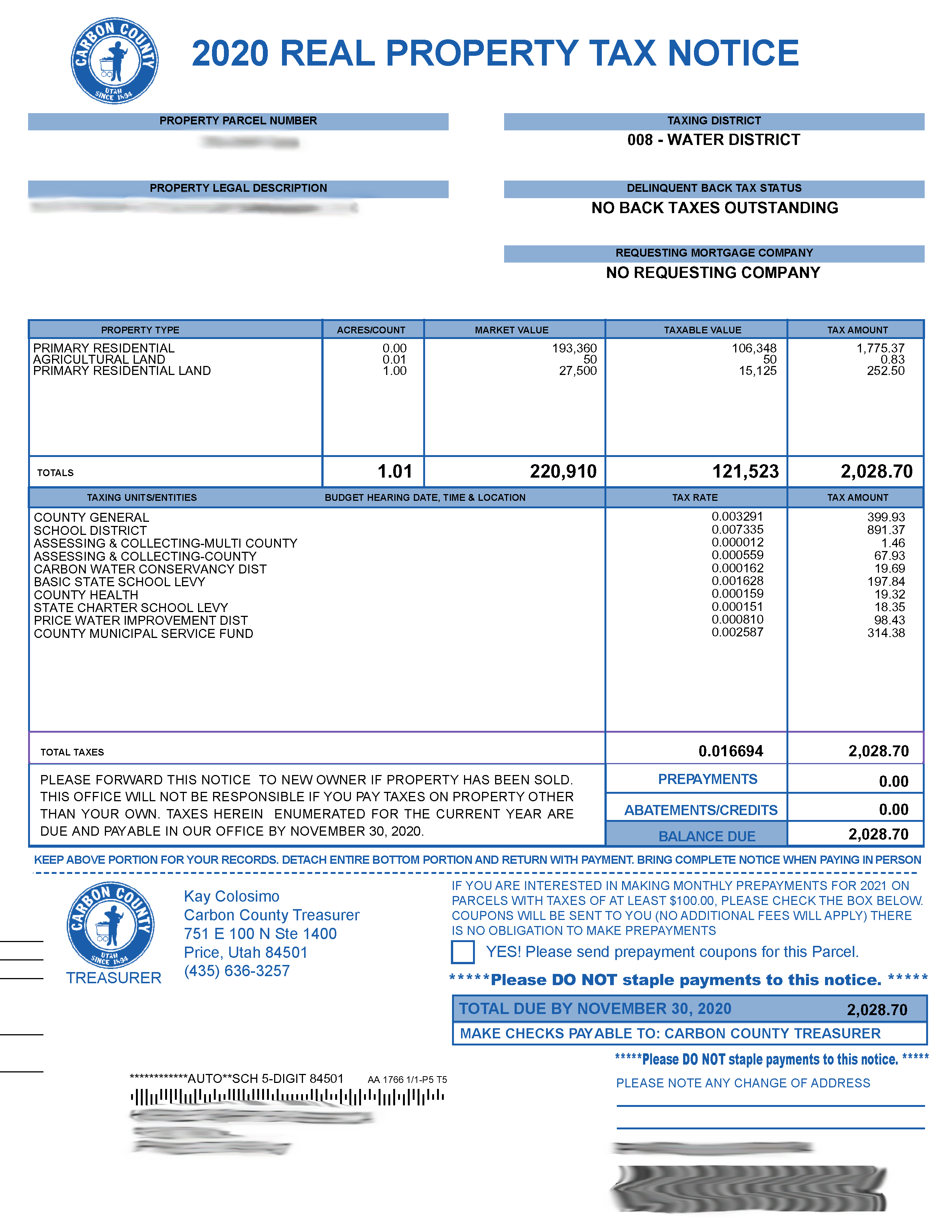

Below you will find an image that will help you understand the many sections of the Tax Notice. These areas all come from each of the tax offices of the county.

The Assessor decides the Property Type, and Market Value

The Recorder reports the Owner, Legal Description, Acreage, and Parcel Number

The Auditor works with the Commission to set the Tax Rate for the county. The other tax rates come from the respective entities.

The Treasure will collect the Total Amount Due, and then distribute the funds to all of the entities.

You can find your own tax notice by clicking here.

Number that describes the real property being taxed.

-This comes from Recorders Office

Legal DescriptionThe legal description of the real property being taxed.

This comes from the Recorders Office

Property TypesThe property type describes the real property being taxed. The type of property affects the value of the real property.

This comes from the Assessor's Office

Taxing EntitiesThese are a list of Taxing Entities that tax the property. Once the County receives your tax payment, we distribute the funds that we collected to each of the entities that are on this list. Carbon County does not retain the entire amount of money that you paid.

AcreageThe size of the real property being taxed.

This comes from the Recorder's Office

Market ValueAssessed Market Value

This comes from the Assessor's Office

Taxable ValueThe Taxable Value is a portion of the Assessed Market Value that will be taxed. This is determined by what the property is used for (i.e. primary residence, land, greenbelt, etc.).

Taxing DistrictTaxing District the real property is located. Taxing Districts determine the tax rates collected.

Delinquent Back TaxNotification that there are delinquent taxes associated with this real property. The delinquent amount will be listed on the back of the tax notice.

This comes from the Treasurer's Office

Requesting MortgageYour mortgage company name will appear here if they are paying your taxes from your escrow account.

This comes from the Treasurer's Office

Tax AmountThe amount of taxes collected.

Tax RatesThe rate each Taxing Entities collects from the real property.

Tax Amount per EntityThe amount collected from each Taxing Entity from the real property

PrepaymentsThis will have an amount IF the property owner has set up prior arrangements with the Treasurer to make prepayments.

AbatmentsThis will have an amount IF the property owner has set up prior arrangements with the Treasurer to make prepayments.

Total DueThe amount of taxes owed.

CouponCheck this box if you are interesting in making prepayments for the next taxing year on this parcel with taxes of at least $100.00. Coupons will be sent to you (no additional fees will apply) in February of the year taxes are due. There is no obligation to make prepayments.

Mailing AddressAll tax notices will be mailed to the name and mailing address listed here.

Change Mailing AddressRequest to change Mailing Address ONLY. Name cannot be changed using this method.